Posted on 31 May 2011. Tags: coach inc, consumer discretionary sector, dow jones, microsoft corp, netapp, profit estimates, quarter earnings, sector index, target, tiffany co

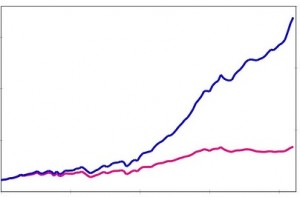

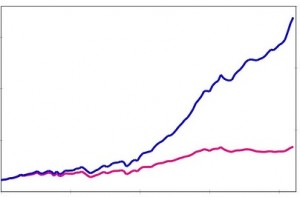

U.S. stocks ended an unstable session with moderately higher gains on Thursday. Upbeat earnings on technology, as well as consumer discretionary stocks outperformed the data, which showed that economy grew at a sluggish rate and unemployment rate abruptly increased.

U.S. stocks ended an unstable session with moderately higher gains on Thursday. Upbeat earnings on technology, as well as consumer discretionary stocks outperformed the data, which showed that economy grew at a sluggish rate and unemployment rate abruptly increased.

The NASDAQ stock market posted the largest gains after NetApp Inc’s strong profits increased the stock 8.6 percent to $56.19. Meanwhile, Microsoft Corp’s shares rose 2.4 percent to $24.77 following a statement from a top investor that its chief executive should step down.

The Dow Jones industrial average rose 0.13 percent or 15.51 points to 12, 410.17. The S&P’s 500 Index climbed 0.31 percent or 4.13 points to 1,324.60. The Nasdaq Composite Index earned 0.70 percent or 19.5 points to 2,780.64.

However, consumer discretionary division performed best, aided by Tiffany & Co, which was up 8.6 percent at $76.03. The luxury seller increased its outlook after releasing its first-quarter earnings.

Coach Inc., the leather goods company famous for its luxury handbags, released 5 percent increase while clothing-line company Guess reported a 15 percent decrease in quarterly profits. But, stocks rose to 11.2 percent as earnings per share came better than estimated. The S&P consumer discretionary sector index climbed 0.8 percent.

The Goldman Sachs reduced its S&P 500 target for the end of the year from 1,500 to 1,450. It is currently the lowest target decided by the banking firm after Citigroup and UBS increased their profit estimates for S&P companies the previous week.

However, unemployment rate reportedly rose last week and remained at high levels. The gross domestic product in the United States climbed at a 1.8 percent yearly rate in the first quarter. It did not change from the last estimate and is still below the expectations of the analysts for stronger growth.

Posted in Finance

Posted on 04 February 2011. Tags: abrupt decrease, archer daniels midland, asia and europe, blue chip, corporate earnings, dow jones, dow jones average, nasdaq index, three decades, us market indices

The Dow Jones Average closed over 12,000 for the first time since June 2008 on Tuesday. This occurred as US stocks shrugged off the turmoil in Egypt and soared on positive corporate earnings.

The Dow Jones Average closed over 12,000 for the first time since June 2008 on Tuesday. This occurred as US stocks shrugged off the turmoil in Egypt and soared on positive corporate earnings.

The entire major US market indices were higher. These were sustained by indications that the United States economy is shifting steadily away from recession. Indications include strong January car sales, better than anticipated growth in manufacturing and solid profits reports from Pfizer, UPS and Archer Daniels Midland.

The blue-chip Dow skipped 1.25 percent or 148.23 points to 12,040.16. That is the first close from the previous 12,000 mark since June 19, 2008.

The broader S&P 500 index leaped 1.67 percent or 21.47 points to 1,307.59, whereas tech-heavy Nasdaq index increased 1.89 percent or 51.11 points to 2,751.19.

The general weakness of markets in U.S., which occurred on Friday and Monday sent a buying signal to investors, analysts said.

Michael James of Wedbush Morgan Securities said the market has been in an upbeat trend for several months now. He said that every shift down over the last six months has confirmed to be an opportunity for buying, and many people viewed the downward move on Friday as the same thing.

However, briefly before President Hosni Mubarak offered to step down after three decades of rule on Tuesday, punters pushed back into stocks.

The near-unanimous increase of markets in Asia and Europe on Tuesday gives another positive atmosphere. The refusal of the stock market to extend Friday’s abrupt decrease was treated as an encouraging sign to buyers. According to analysts at Briefing.com, gains abroad also provided a positive backdrop for further buying this session.

Posted in Business

Posted on 12 January 2011. Tags: 10 year treasury, consumer stocks, dow jones, hewlett packard co, iphone, new york stock, new york stock exchange, sears holdings corp, verizon communications inc, year treasury note

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Two companies raised their earning forecasts for this year. Sears Holdings Corp said that they could earn twice as much as the analysts had foretold this year. Tiffany & Co. also said that vigorous holiday sales will push their earnings higher.

According to Matt Lloyd, chief investment strategist at Advisors Asset Management, the consumer stocks have been left for dead. The consumer companies had slashed so many costs during the recession and he said that any slight changes in the spending this year will make a much bigger effect on margins.

Hewlett-Packard Co. became one of the leaders in the Dow Jones industrial average. This happened when analysts at the UBS increased their earnings estimates for the company that creates computers.

AT&T Inc. and Verizon Communications Inc. were the two lowest companies on the Dow Jones list. Verizon fell 1.6 percent to $35.36 while AT&T fell 1.5 percent to $27.91.

Verizon will start selling their version of Apple Inc’s iPhone this coming February 10. This will break AT&T’s strong grip on the famous phone. They were the exclusive carrier of the phone since launched in 2007.

Aside from stocks, yields went higher as bond prices fell. The yield on the 10-year Treasury note increased to 3.34 percent from 3.29 percent late Monday. The yield is utilized to put interest rates on several kinds of loans that includes mortgages.

There are about three stocks that increased for every one that dropped on the New York Stock Exchange. The consolidated volume noted was 4.1 billion shares.

Posted in Finance

U.S. stocks ended an unstable session with moderately higher gains on Thursday. Upbeat earnings on technology, as well as consumer discretionary stocks outperformed the data, which showed that economy grew at a sluggish rate and unemployment rate abruptly increased.

U.S. stocks ended an unstable session with moderately higher gains on Thursday. Upbeat earnings on technology, as well as consumer discretionary stocks outperformed the data, which showed that economy grew at a sluggish rate and unemployment rate abruptly increased.

The Dow Jones Average closed over 12,000 for the first time since June 2008 on Tuesday. This occurred as US stocks shrugged off the turmoil in Egypt and soared on positive corporate earnings.

The Dow Jones Average closed over 12,000 for the first time since June 2008 on Tuesday. This occurred as US stocks shrugged off the turmoil in Egypt and soared on positive corporate earnings. Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.