Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Two companies raised their earning forecasts for this year. Sears Holdings Corp said that they could earn twice as much as the analysts had foretold this year. Tiffany & Co. also said that vigorous holiday sales will push their earnings higher.

According to Matt Lloyd, chief investment strategist at Advisors Asset Management, the consumer stocks have been left for dead. The consumer companies had slashed so many costs during the recession and he said that any slight changes in the spending this year will make a much bigger effect on margins.

Hewlett-Packard Co. became one of the leaders in the Dow Jones industrial average. This happened when analysts at the UBS increased their earnings estimates for the company that creates computers.

AT&T Inc. and Verizon Communications Inc. were the two lowest companies on the Dow Jones list. Verizon fell 1.6 percent to $35.36 while AT&T fell 1.5 percent to $27.91.

Verizon will start selling their version of Apple Inc’s iPhone this coming February 10. This will break AT&T’s strong grip on the famous phone. They were the exclusive carrier of the phone since launched in 2007.

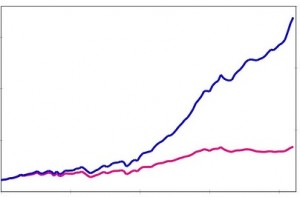

Aside from stocks, yields went higher as bond prices fell. The yield on the 10-year Treasury note increased to 3.34 percent from 3.29 percent late Monday. The yield is utilized to put interest rates on several kinds of loans that includes mortgages.

There are about three stocks that increased for every one that dropped on the New York Stock Exchange. The consolidated volume noted was 4.1 billion shares.