Posted on 14 January 2011. Tags: borrowers, foreclosures, housing market, purchase mortgage, treasury bonds, treasury yields, unemployment rate, year fixed mortgage, year mortgage, year treasury note

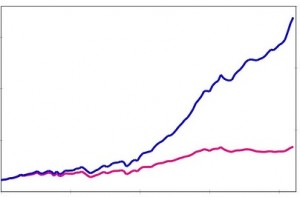

Rates on fixed mortgages dropped for the second straight week at the same time Treasury yields are falling.

Rates on fixed mortgages dropped for the second straight week at the same time Treasury yields are falling.

The average rate on the 30-year mortgage sank to 4.71 percent this week from 4.77 percent the preceding week, Freddie Mac said on Thursday. In November, it had reached its lowest rate of 4.17 percent in 40 years.

The 15-year loan average rate dropped to 4.08 percent from 4.13 percent. It hit also hit 3.57 percent in November, the lowest rate it has ever recorded since 1991.

After the December employment report showed weaker than expected, Treasury yields dropped which moved investors to buy safer Treasury bonds. This increased its prices and lowered the yields. The 10-year Treasury note shows mortgage rates tend to trail behind the yields.

After the 40-year low in November, rates have been rising. However, investors moved their money out of Treasury and into stocks as they anticipated faster economic growth and higher inflation. Yields are apt to increase along with inflation fears.

The latest drop in rates have convinced some borrowers to refinance, but upcoming buyers remain cautious. On Wednesday, the Mortgage Bankers Association said that the number of homeowners looking to refinance increased last week. Yet, the number of people applying for a purchase mortgage fell a week ago.

Higher rates are just another obstacle that struggling housing market face. High unemployment rate, increasing foreclosures, and falling home prices are the other factors that are slowing down the market’s recovery.

Posted in Finance

Posted on 12 January 2011. Tags: 10 year treasury, consumer stocks, dow jones, hewlett packard co, iphone, new york stock, new york stock exchange, sears holdings corp, verizon communications inc, year treasury note

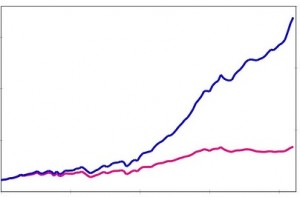

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Two companies raised their earning forecasts for this year. Sears Holdings Corp said that they could earn twice as much as the analysts had foretold this year. Tiffany & Co. also said that vigorous holiday sales will push their earnings higher.

According to Matt Lloyd, chief investment strategist at Advisors Asset Management, the consumer stocks have been left for dead. The consumer companies had slashed so many costs during the recession and he said that any slight changes in the spending this year will make a much bigger effect on margins.

Hewlett-Packard Co. became one of the leaders in the Dow Jones industrial average. This happened when analysts at the UBS increased their earnings estimates for the company that creates computers.

AT&T Inc. and Verizon Communications Inc. were the two lowest companies on the Dow Jones list. Verizon fell 1.6 percent to $35.36 while AT&T fell 1.5 percent to $27.91.

Verizon will start selling their version of Apple Inc’s iPhone this coming February 10. This will break AT&T’s strong grip on the famous phone. They were the exclusive carrier of the phone since launched in 2007.

Aside from stocks, yields went higher as bond prices fell. The yield on the 10-year Treasury note increased to 3.34 percent from 3.29 percent late Monday. The yield is utilized to put interest rates on several kinds of loans that includes mortgages.

There are about three stocks that increased for every one that dropped on the New York Stock Exchange. The consolidated volume noted was 4.1 billion shares.

Posted in Finance

Rates on fixed mortgages dropped for the second straight week at the same time Treasury yields are falling.

Rates on fixed mortgages dropped for the second straight week at the same time Treasury yields are falling.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.

Strong earnings from big retailers, as well as an update to for Hewlett-Packard helped put stocks to better position on Tuesday.